Common Types of Investment: Direct Index Investing, ETF, or Mutual Fund Investing. What is Right for You?

By LRVS Advisory Group

Apr 4, 2023

Investing in the stock market offers various types of investment options, which can be confusing. Deciding which type of investment strategy is right for you is key to success. Mutual fund investing and ETF (Electronically Traded Funds) have been two popular investment strategies. As a demand has grown for more customized portfolios, direct index investing has become a newer investment strategy. [1] In this blog, we will explore the differences between these strategies.

MUTUAL FUND INVESTING

Mutual funds are investment vehicles that take money from different investors to purchase stocks, bonds, or other securities.[2] By investing in a mutual fund, investors gain access to professional management by experienced investment professionals.[3] Mutual fund investing also provides investors with instant diversification, as they invest in a range of securities, spreading their investment across different companies and sectors.

However, mutual funds come with some drawbacks. They charge fees, including expense ratios, sales charges, and management fees, which can eat into your investment returns over time.[4] Mutual funds offer limited customization as you’re essentially buying into a portfolio managed by someone else, and you don’t own any of the individual stocks or have a say in the investing or changes that may come. Lastly, as mutual funds are professionally managed, investors may not be able to take advantage of tax-efficient strategies that would otherwise be available with direct indexing.[5]

ETFs (EXCHANGE-TRADED FUND) INVESTING

An ETF (Exchange-Traded Fund), like Mutual Funds, is a type of investment fund that trades on a stock exchange like a stock.[6] ETFs are made up of a basket of assets such as stocks, bonds, commodities, or currencies. An investor can choose to invest in a specific ETF that tracks a particular index, such as the S&P 500, or in an ETF that is focused on a specific sector or industry.[7] ETFs are also available for bonds, commodities, and other asset classes. ETFs allow investors to gain exposure to a diversified portfolio of assets with lower fees and higher liquidity than traditional mutual funds. [6]

Different from a mutual fund, ETFs can be bought and sold just like stocks, while mutual funds can only be purchased at the end of the trading day at the net asset value (NAV) price. [8] One of the benefits of ETF investing is the ability to diversify a portfolio with a single investment, as ETFs typically hold underlying assets.[7] ETFs also provide a way for investors to gain exposure to hard-to-reach markets or sectors, such as foreign markets or emerging industries.[9]

There are drawbacks to investing in ETFs such as less diversification, costs could be higher, lower dividend yields, leveraged ETF returns skewed, trading fees, operating expenses, low trading volume, tracking errors, hidden risks, and lack of liquidity.[10] [6]

DIRECT INDEXING

Direct indexing investing allows investors to build customized portfolios of individual stocks. With direct indexing, you buy individual stocks that match a particular market index or benchmark, such as the S&P 500.[11] The goal is to create a portfolio that tracks the performance of the index, while also providing the investor with control over their portfolio. Essentially, direct indexing involves choosing the index you want to replicate the performance of and then buying a representative amount of all its constituent stocks. [11][12] Direct indexing allows investors to directly own the securities that make up an index.[13] With direct indexing, investors have the flexibility to exclude certain stocks from their portfolio or to overweight certain sectors or industries.

One of the primary benefits of direct indexing is customization. Unlike mutual funds, you have complete control over your portfolio and can choose which stocks to buy, sell, or hold.[14] This means you can tailor your investments to align with your specific financial goals, risk tolerance, and personal values.[14] Direct indexing typically has lower fees compared to mutual funds, which can save investors money in the long run.[15]

Direct indexing also allows investors to benefit from tax-loss harvesting, which involves selling losing positions to offset capital gains and lower taxes.[13] Direct indexing can be more tax-efficient than mutual funds. Since you own individual stocks, you can take advantage of tax-loss harvesting, which involves selling losing positions to offset capital gains and potentially lower your tax bill.[11]

Direct indexing is a powerful investing strategy that can unlock tax alpha opportunities, which are not available from mutual funds and ETFs.[16] Tax alpha, the potential value created of an investment by the portfolio manager, is calculated by subtracting the excess pre-tax return from the after-tax return. The total excess after-tax return indicates how well the portfolio manager has managed taxes on behalf of investors.[17] According to research done by Orion Portfolio Solutions, the potential value create by the effective tax management of direct index investing is expected to be around 1+% per year difference between another investment vehicle, like an ETF fund.[18]

However, direct indexing is not without its downsides. For starters, it requires a lot of research, time, and effort to build a diversified portfolio of individual stocks. It requires investors to actively manage their portfolios and stay up to date on market conditions.

WHICH IS RIGHT FOR YOUR PORTFOLIO?

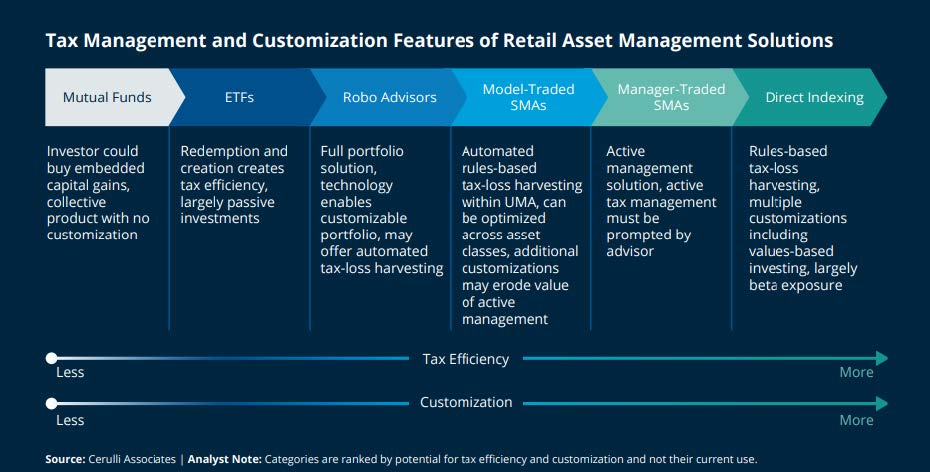

Deciding whether to invest in mutual funds, ETFs or direct indexing depends on your personal circumstances and investment objectives. All these options have their benefits and drawbacks. As your investment needs and goals become more complicated you might find yourself wanting a more customized investment strategy, like direct index investing. The chart below is a good visualization to show the amount of customization and tax management with different investment strategies.

Direct indexing can provide greater autonomy, control, and tax advantages to certain investors over owning a mutual fund or ETF. The direct indexing strategy can be a valuable tool for investors looking to achieve their financial goals. By working with a financial advisor, you can take advantage of the benefits of direct indexing while receiving expert guidance and support. They can also help you avoid common mistakes that could negatively impact your portfolio.

When it comes to investing, there is no one-size-fits-all solution. Both mutual funds and direct indexing offer their unique advantages and disadvantages. Ultimately, the best investment strategy is one that aligns with your financial goals, risk tolerance, and personal values. If you’re interested in learning more about the types of investment, including direct indexing, or working with a financial advisor, contact us today!

ADVISOR SOURCES FOR INVESTORS

- 1https://www.cnbc.com/2022/06/27/direct-indexing-becomes-democratized-as-fees-account-minimums-drop.html

- 2https://www.investor.gov/introduction-investing/investing-basics/investment-products/mutual-funds-and-exchange-traded-1

- 3https://smartasset.com/investing/should-i-invest-in-mutual-funds

- 4https://www.investopedia.com/ask/answers/10/mutual-funds-advantages-disadvantages.asp

- 5https://www.bankrate.com/investing/mutual-funds-advantages-disadvantages/

- 6https://www.investopedia.com/articles/exchangetradedfunds/11/advantages-disadvantages-etfs.asp

- 7https://www.investopedia.com/terms/e/etf.asp

- 8https://www.investopedia.com/articles/exchangetradedfunds/08/etf-mutual-fund-difference.asp

- 9https://www.kiplinger.com/investing/etfs/604794/best-etfs-to-battle-a-bear-market

- 10https://www.titan.com/articles/etf-drawbacks

- 11https://www.fidelity.com/learning-center/trading-investing/direct-indexing

- 12https://www.morganstanley.com/articles/what-is-direct-indexing-benefits#:~:text=What%20Is%20Direct%20Indexing%3F,make%20up%20the%20chosen%20index

- 13https://russellinvestments.com/us/blog/direct-indexing

- 14https://www.morganstanley.com/articles/what-is-direct-indexing-benefits

- 15https://www.adhesionwealth.com/resources/blog/how-to-generate-tax-alpha-with-direct-indexing

- 16https://smartasset.com/taxes/how-to-calculate-tax-alpha

- 17https://www.orionportfoliosolutions.com/blog/buzz-over-direct-indexing/

- 18https://blogs.cfainstitute.org/investor/2021/11/08/the-mirage-of-direct-indexing/

- 19Chart Source: https://image.marketing.cerulli.com/lib/fe3411737164047c7d1072/m/1/6a289e24-e24d-4168-9268-b39755ecfb32.pdf?utm_source=MarketingCloud&utm_medium=email&utm_campaign=WhitePaperConfirmation&utm_content=WhitePaperDownload

*Disclaimer:

This article is provided by McAdam LLC dba The LRVS Advisory Group for informational purposes only. Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance may not be indicative of future results and may have been impacted by events and economic conditions that will not prevail in the future. No portion of this article is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax, or legal advice. Certain information contained in this report is derived from sources that McAdam believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages.

Any references made regarding the taxable nature of your investments should not be construed as tax advice. McAdam LLC is not a tax advisory firm; therefore, any tax decisions or assumptions should be made/verified with your tax professional.

Projected savings presented may vary depending on client longevity, and performance of assets over time.

This article is the sole opinion of this individual and is not indicative of the firm’s belief.